Blank 1099 Tax Form

- 28 September 2023

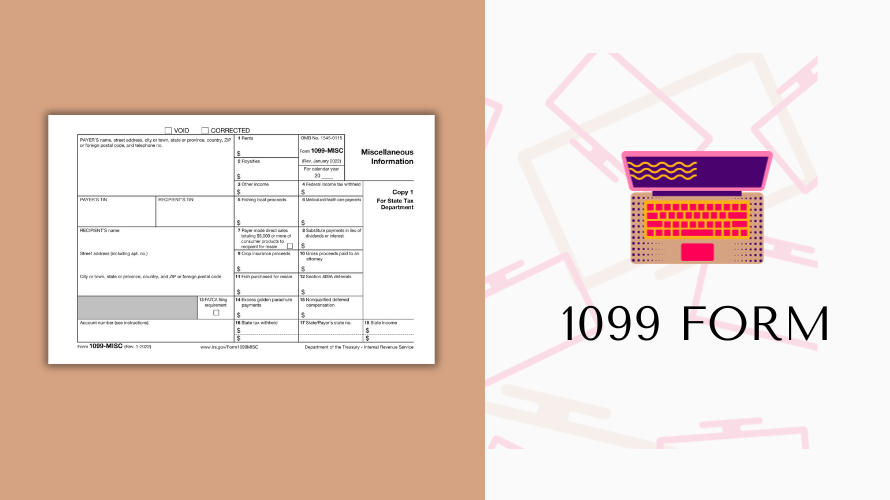

In the wide array of tax documents, IRS Form 1099 stands out for its wide usage. Essentially, the 1099 blank form handles the reporting of income from self-employment earnings, as well as interest and dividends, government and debt cancellations, and other sources of income. Those who need to print a blank 1099 form are generally independent contractors or individuals who are not employed under a business entity but provide services as a separate entity.

Who Should Not Use Form 1099?

Just as it’s important to know who should use a blank 1099 tax form, it's also crucial to understand who should not. Regular employees receiving a conventional wage should not use Form 1099, as their employers will utilize the W-2 form instead. Additionally, corporations considered employees by common law or statutory employees are not suitable candidates for a 1099 form.

- Employers with a payroll staff should not use a blank 1099 form for their employees.

- Corporations, even if they are small or family-owned, are not required to use this form. They have a separate set of IRS tax forms

- Workers classified as employees by prevailing laws, including statutory employees, cannot use a 1099 form for their income needs.

Form 1099 in Action: A Fictional Example

Meet John, a freelance graphic designer who was paid a total of $5,000 for various projects he provided to his clients throughout the current tax year. In order to correctly report his income, he’ll need to print and make use of a blank fillable 1099 form. He will then provide details pertaining to his earnings from his freelancing work. If, for instance, he incurred costs related to his freelance work, these may also be listed and potentially deducted, ensuring that John is paying taxes based on his net profit, not his gross earnings.

Handling a 1099 Form: Common Problems & Solutions

| Problems with Blank Form 1099 | Solutions |

|---|---|

| Unsure of what income to include | Consultation with an accountant or utilization of online tax software |

| Confusion on how to deduct business expenses | Expenses directly linked to generating the income can typically be deducted. To properly do this, make sure to keep impeccable records of your business expenses. |

| Filling out multiple 1099 forms for multiple clients | Each client you have done $600 or more work for must be addressed independently on their own Form 1099. This ensures proper reporting adherence for all involved parties. |

Whether you're a freelancer, a small business owner, or an independent contractor, knowing your way around a blank Form 1099 is essential to correct financial record-keeping. Remember, there is always professional help available should you need it, and don’t be afraid to consult an accountant or financial adviser.