How to File Form 1099 Online

- 15 September 2023

Whether you are an independent contractor, a business owner, or you have other sources of income apart from your salary, tax forms are an integral part of financial management. Today, we will focus on the 1099 form, a critical tax document required by the Internal Revenue Service (IRS). This official yet simple guide is designed to provide valuable information on how to get the 1099 online and fill out the document correctly.

Understanding Form 1099

Form 1099 is employed by the IRS to track your extra income outside of your regular earnings. There are various versions of Form 1099, but a commonly used one is the 1099-MISC, which is required for miscellaneous income. The digital age has eased the process significantly. Now, one can access the 1099 form online for free, a feature that offers significant convenience and accessibility.

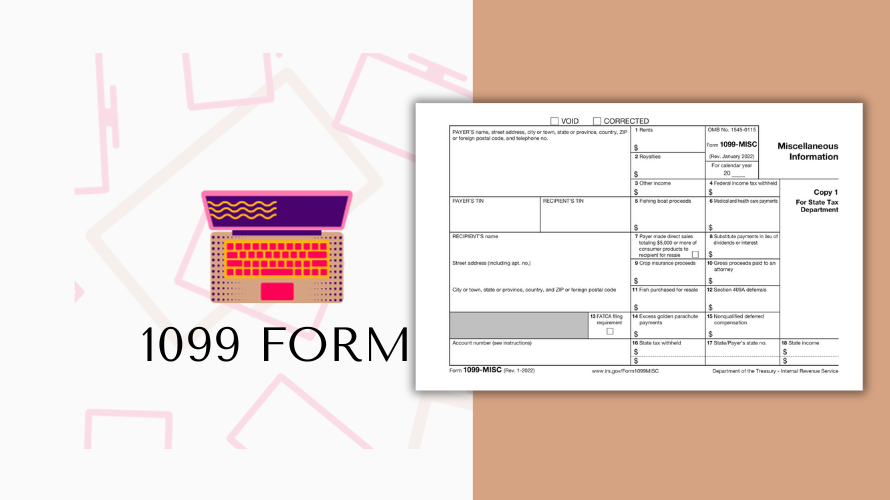

Fillable Version of Form 1099

Filing taxes has never been easier with the availability of the free online 1099-MISC form, which is interactive and user-friendly. The form is detailed and includes various sections like the payer's and recipient's information, federal and state income, and expenses, among other details. Both the payer and recipient can easily fill out and file Form 1099 online without any specialized knowledge or software. This process is essentially as simple as filling out a regular form - the fillable fields are clickable, and you get immediate feedback if you overlook a required field.

1099 Online Form & Potential Challenges

While the process is simplified by being able to file the 1099-MISC online for free, it can also come with a set of challenges. Some individuals may encounter difficulties regarding filling out accurate details in the form, making sure all information lines up with their financial documents, and ensuring proper compliance with tax requirements. It's essential to fill out all form fields accurately to avoid complications during the tax review process by the IRS.

Filing Form 1099 Online Successfully

- First and foremost, ensure you have all the necessary financial details at hand.

- Use a secure and reliable platform or IRS website for accessing and filing the 1099-MISC form online to maintain the security of personal information.

- If you are unfamiliar with this form, seek help from a tax professional to guide you in filling out the form, or use a reputable online tax software.

- Finally, always double-check your form for errors before submitting it online. Incorrect forms may cause unnecessary delays in the tax refund process.

Whether you are filing a 1099 form for the first time or it's an annual task for you, this guide aims to smooth your tax filing experience by providing you with practical pointers. Remember that accurate and timely tax filings are key to stress-free financial management.