Federal Tax Form 1099 for Self-Employed: Guides & Tips

The Internal Revenue Service issues various documents to manage taxation, including the 1099 tax return form. This document is an information return the IRS uses to track income from sources other than wages, salaries, and tips. Form 1099 is utilized by various individuals and entities, such as freelancers, independent contractors, and investment companies. Importantly, this tax form has multiple versions to accommodate different income types. On our website, you can get Form 1099 in PDF for the 2023 tax year in a few clicks.

What We Offer

When dealing with taxes, especially navigating through forms like the printable 1099 IRS tax form, having a reliable and comprehensive resource is invaluable. That's where our platform, 1099-taxform.net, comes in handy. Our website is designed to clarify tax procedures and provisions, making the vast taxation domain more manageable for individuals. We provide a wealth of materials, including detailed instructions and practical examples, to guide you in filling out these forms accurately. By utilizing these resources, taxpayers can complete their requirements more efficiently, helping them avoid penalties and adhere to IRS regulations.

IRS 1099 Form & Taxpayers Who Need It

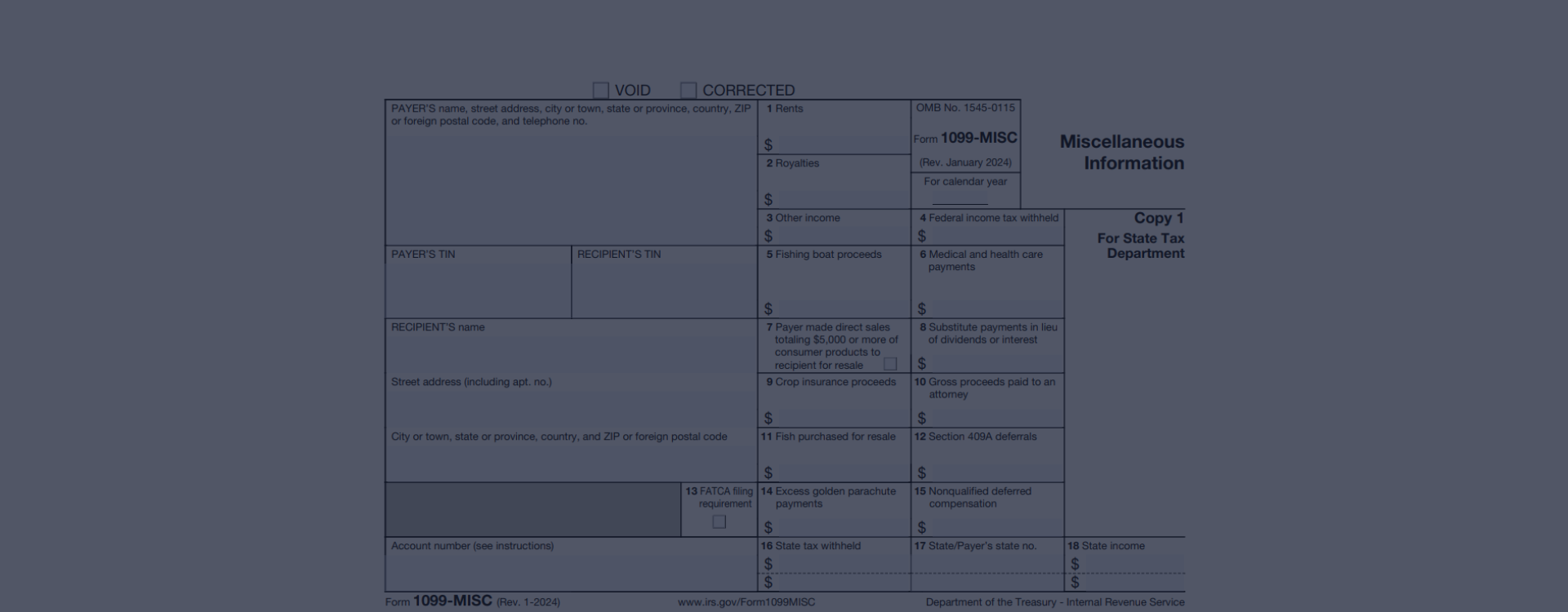

The 1099 form is a document that must be filed by individuals or entities that provide services, often defined as freelance or contract work. Simply put, federal tax form 1099-MISC reports income from self-employment earnings, interests, dividends, government payments, etc.

The first person in our example is Tim, a freelance graphic designer. His numerous clients pay him for his creative services throughout the year. As a self-employed individual, Tim represents a typical case of those obliged to file the 1099 form. His income, not subjected to automatic tax withholding, must be reported to the IRS. Thus, at the end of the fiscal year, he will collect a blank printable 1099 form for 2023, fill it out, and submit it accordingly.

Next, meet Maria, a landlord who rents out several properties. The rent income she receives surpasses the $600 threshold, compelling her to report this cash flow. Maria decided to file the 1099 form online, simplifying the reporting process and saving time and resources. In both Tim and Maria's scenario, filing the 1099 form helps maintain transparency with tax obligations and ensures adherence to U.S. taxation laws.

1099 Tax Form in PDF for 2023

Get FormIRS Form 1099: Purpose & Features

-

![Freelancer Tracking]() Freelancer TrackingThe primary aim of the federal 1099 form is to record money paid to freelancers or independent contractors. Unlike regular employees who receive W-2 forms, freelancers get 1099 copies because they're not subject to automatic withholding from their paychecks.

Freelancer TrackingThe primary aim of the federal 1099 form is to record money paid to freelancers or independent contractors. Unlike regular employees who receive W-2 forms, freelancers get 1099 copies because they're not subject to automatic withholding from their paychecks. -

![Rental Revenue Reporting]() Rental Revenue ReportingAnother significant objective of the 1099-MISC tax form is to document income earned from rental properties. Property owners must report this revenue to the IRS, and using this document helps standardize the process, making it easier to audit if necessary.

Rental Revenue ReportingAnother significant objective of the 1099-MISC tax form is to document income earned from rental properties. Property owners must report this revenue to the IRS, and using this document helps standardize the process, making it easier to audit if necessary. -

![Prize Money Declaration]() Prize Money DeclarationIt records prize money, awards, or other miscellaneous income forms. If a reality show winner receives a cash prize, this income must be reported to the IRS. This process ensures that all taxable income is captured accurately, leading to a fair and equitable tax system.

Prize Money DeclarationIt records prize money, awards, or other miscellaneous income forms. If a reality show winner receives a cash prize, this income must be reported to the IRS. This process ensures that all taxable income is captured accurately, leading to a fair and equitable tax system.

Fill Out the 1099-MISC Form in 2023 Error-Free

Filling out a 1099-MISC form correctly can be daunting, especially if you're a newbie. Fear not, as this guide is intended to help streamline the process and avoid mistakes.

- First, make sure you have all the necessary information at hand - payer's information, recipient's identification details, and, of course, the income details. To get started, you can find the 1099 form to download for free from our website's offered resources.

- When you're ready to fill in the template, be sure to enter the financial year at the top of your downloaded copy. In the first box, insert the total amount paid during a calendar year; it should exclude simple reimbursements. Once you have received your blank 1099 form for print, meticulously double-check all entered details.

- Before finishing, make sure you comprehend all the data mentioned there. If the template seems too complicated or you're unsure, opt to use our digital 1099 online form for free. Our platform assists in reducing errors and compliance with IRS guidelines. Get started on your journey to accurate tax filing today!

Due Date for 1099 in 2023

For those obliged to file an income tax form 1099, please be advised the deadline is January 31st of the year following the fiscal period. This means you should submit the 1099 tax form for 2023 printable by January 31, 2024. Compliance is critical in tax matters.

Fill FormIRS 1099 Form & Related Penalties

Skipping the deadline for filing or providing fraudulent information may lead to penalties. If you need to arrive earlier, let's say you file within 30 days from the due date; the penalty would be $50 per copy. If the delay is more significant, up to August 1, for example, the fine jumps to $110. Beyond that, or for intentionally disregarding to provide correct information, the penalty could surge to $270 per copy. So, it's better to be accurate and punctual. Remember, an income tax form 1099 printable is readily accessible online to ease your filing process.

Income Tax Form 1099: Popular Questions

- Is a free printable 1099 tax form available for non-residents?It is not explicitly specified whether the 1099 sample is available specifically for non-residents. However, the IRS provides tax-related documents, which could also cater to non-residents' needs.

- How much time do I need to complete the IRS 1099 tax form printable independently?The amount of time needed to complete the 1099 sample independently varies considerably based on individual situations and the complexity of the tax circumstances. Nonetheless, allowing a few hours to read through the instructions and complete the document accurately and thoroughly is generally advisable.

- Is the printable 1099 tax form free to download on this website?Yes, there is an option to download the 1099 in PDF. We provide a clear and comprehensive guide in this process. You only need to navigate through the site, download the PDF file, and print it at your own convenience without incurring any cost.

- Can I print the 1099 tax form for free?Yes, the 1099 tax form is typically free to print. Scroll to the top of the screen and click the "Get Form" button. You'll see the blank 1099 template in the new window. Then, you need to click the "Print" button and set your printer.

- What are the pros of the free fillable 1099 form for online filling?The benefits include a user-friendly interface that ensures handy entries, less likelihood of computational errors as calculations are done automatically, and the convenience of direct online submission – reducing paper usage and saving time. Going online can offer a streamlined, more efficient process than manual paperwork.

Form 1099 Instructions for Independent Contractors

Blank 1099 Tax Form In the wide array of tax documents, IRS Form 1099 stands out for its wide usage. Essentially, the 1099 blank form handles the reporting of income from self-employment earnings, as well as interest and dividends, government and debt cancellations, and other sources of income. Those who need to print...

Blank 1099 Tax Form In the wide array of tax documents, IRS Form 1099 stands out for its wide usage. Essentially, the 1099 blank form handles the reporting of income from self-employment earnings, as well as interest and dividends, government and debt cancellations, and other sources of income. Those who need to print... - 28 September, 2023

- 1099-MISC Tax Form The 1099-MISC tax form originates from the Internal Revenue Service (IRS) structure, which maintains various types of 1099 forms to report different types of income. Among these, the printable 1099-MISC form has a significant place. This form began as a way for businesses to report payments made to...

- 27 September, 2023

- How to File Form 1099 Online Whether you are an independent contractor, a business owner, or you have other sources of income apart from your salary, tax forms are an integral part of financial management. Today, we will focus on the 1099 form, a critical tax document required by the Internal Revenue Service (IRS). This officia...

- 15 September, 2023

Please Note

This website (1099-taxform.net) is an independent platform dedicated to providing information and resources specifically about the 1099 form, and it is not associated with the official creators, developers, or representatives of the form or its related services.